Mortgage Lending Is Falling

If laughter truly is the best medicine then today’s blogpost lies somewhere between snake oil and the fountain of youth. It’s just a question of who to believe…

Mortgage Insights With One Eyebrow Raised

Mortgage Lending Is Falling

If laughter truly is the best medicine then today’s blogpost lies somewhere between snake oil and the fountain of youth. It’s just a question of who to believe…

In the rush to be first with a story online, some websites fail to provide the full picture of what is happening.

A month has passed, so what do we really think of NAMA’s deferred mortgage scheme?

[Read more...]

Let’s face it, a headline such as ‘Property Prices Continue To Fall In April 2012‘ is pretty gloomy. But there’s just no getting around the facts. Post-economic meltdown momentum continues to affect us like a Crash Test Dummy. [Read more...]

There is a strong possibility that the ECB will increase interest rates soon, due to inflationary pressures caused by rises in oil prices and other commodities.

This will have an impact on the depressed property market, which is struggling due to lack for mortgage funds from the Banks and the reduced incomes suffered by people in general due to the economic downturn and the government cutbacks. [Read more...]

Irish Interest Rates, is there a more thorny topic in Ireland in 2011?

It looks like the ECB will increase it base rate in April as inflation continues to be a problem. With interest rates on the rise this will have a negative effect on the Irish economy and the property sector as it will affect mortgage rates. [Read more...]

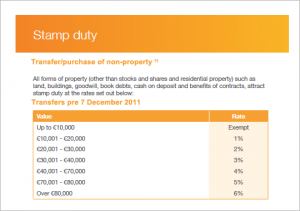

Looking for information on Stamp Duty in Ireland?

The Minister announced in the December budget that he has reduced the stamp duty on residential property sales to 1%for prices up to €1 million. This should help people who are trading up or trading down. [Read more...]

Copyright © 2024 · Genesis Framework · WordPress · Log in